Our Goal

Our objective is to facilitate efficient and secure money movement through a suite of innovative solutions. We offer next-generation card payment systems with instant enrollment and ATM access, as well as cutting-edge virtual disbursement solutions. This ensures that funds move quickly, reliably, and securely.

Solutions for Public Service Programs

DHS / DSS

- Providing digital banking and payment solutions for various Human and Social Service programs (SNAP, TANF, Foster Care, Childcare subsidies)

- Initiatives: Healthcare access, public health, social services, education opportunities

Disbursements

- Unemployment Benefits

- Corrections / Inmate Funds

- Child Support

- Cash Assistance

- Foster Care Payments / Stipends

Education + Specialty Programs

- Facilitating educational funding disbursements and financial aid programs

- Customized solutions for unique community needs

- Alternative employment and financial inclusion

What Makes Our Government Disbursements Superior?

Rellevate’s Public Sector solution excels in delivering reliable, secure, and efficient government payment services. Our transaction handling provides comprehensive transaction tracking, enhanced spending decision support, and thorough expenditure validation.

- Comprehensive transaction tracking and verification, both pre-authorization and post-transaction

- Enhanced spending decision support

- Thorough validation of expenditures

At Rellevate, we prioritize seamless integration and robust security measures to guarantee timely and secure disbursement of benefits to citizens. Built on innovation, transparency, and a deep understanding of government agencies’ unique needs, our solution empowers them to serve their communities with excellence

Transform Your Disbursement Experience with Our Contactless Payment Solutions

- Digital wallets with best-in-class funds distribution

- Immediate access to payments for government programs

- Process reimbursements at the State, County, and City governments

- Advanced fraud detection and prevention capabilities

- Leverage Rellevate's experience to distribute funds seamlessly

Transform Your Disbursement Experience With Our Contactless Payment Solutions

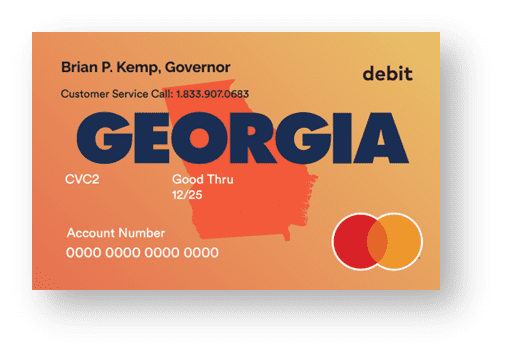

Real World Impact: A Case Study in Success

The State of Georgia and Rellevate partnered to distribute funds totaling over $1 Billion in just weeks from program inception.

A Positive Digital Payments Experience

Rellevate partners with the public sector using cutting-edge digital distributions and engagement solutions. Rellevate’s digital pay platform is built for superior, seamless engagements. It is redefining how State, County, and City Governments, School Districts, and Nonprofit Organizations interact with their recipients and drive faster, more secure digital transactions.

Speed: Rellevate’s Custom and Flexible 30-Day Programs

Rellevate’s proven fast-track programs can distribute billions of dollars within weeks of program approval and distribute those funds using the latest transfer techniques and across multiple channels.

FAQ

Frequently Asked Questions

Entities can streamline disbursements with Rellevate. Our expertise helps tailor solutions, integrate digital platforms, and educate stakeholders on the advantages of efficient disbursement processes.

Rellevate ensures transaction security through advanced encryption protocols, multi-factor authentication, real-time fraud monitoring, and compliance with industry standards including PCI-DSS (Payment Card Industry Data Security Standard).

Yes, Rellevate offers cost-effective payment solutions that reduce overhead costs for governments and organizations, optimize transaction fees, and streamline payment processes.

Yes, Rellevate’s payment solutions are designed to seamlessly integrate with existing government systems, ensuring compatibility, and minimal disruption to operations.

Yes, Rellevate provides comprehensive training and ongoing support for government staff to ensure they can effectively use our disbursement solutions. Additionally, dedicated support teams are available to address any questions or concerns that may arise.