Resources

In the News

latest news and resources from the Rellevate News Desk

Press Releases

Mayor Scott, Office of African American Male Engagement, and Rellevate Inc. Launch Same Day Work Pilot

View the original press release here. Partnership Advances Squeegee Collaborative Action Plan, Aims to Deliver Same-Day Payments to Former Squeegee Workers. BALTIMORE, MARYLAND, UNITED STATES, June 21, 2023 – Today, Mayor Scott announced a pilot program aimed to provide former squeegee workers with same-day work opportunities and a daily stipend beginning the week of June 19, 2023. In partnership with Rellevate Inc., a digital payment services provider, the Same Day Work Pilot Pay further expands the mission of the Mayor’s Office of African American Male Engagement (MOAAME) and the City’s Squeegee Collaborative Action Plan, by providing former squeegee workers with same-day work opportunities and swift payment of a daily stipend via a Rellevate Digital Account with Visa Debit Card. MOAAME coordinates the Same Day Work Pilot

Rellevate and Payroll4Free to Offer Financial Wellness Benefit to Business Clients

STAMFORD, CT, USA, August 18, 2022 /EINPresswire.com/ — Rellevate, Inc., a digital banking & payment services provider today announced a partnership with Payroll4Free, the only provider of free online payroll services, headquartered in Beachwood OH. Together they will offer Payroll4Free Clients and their employees’ access to Rellevate’s Digital Account with Earnings Credit, Visa Debit Card, Send Money, Bill Pay and Pay Any-Day, an Earned Wage Access product. “It is important to Rellevate to offer our comprehensive financial services tools to empower employees at both small and large companies, and the opportunity to work with Payroll4Free and their small business clients to provide this Financial Wellness benefit to their employees is rewarding, said Stewart Stockdale, Co-Founder, Chairman & CEO of Rellevate. “At virtually no cost to

Rellevate Secures Series Seed Preferred Investment to Scale Digital Banking and Payment Services Aimed for American Workers

Naples Technology Ventures led successful Capital Raise to Fuel Company’s Growth Stamford, CT, May 20, 2022 — Rellevate, Inc., a digital banking & payment services provider today announced that it closed a Series Seed Preferred $4 million round led by Naples Technology Ventures (NTV). Additional investors included Connecticut Innovations, IAG Capital Partners, Cherrystone Angel Group, Texas HALO Fund and Tamiami Angel Fund, among others. As a fintech company dedicated to empowering consumers through leading-edge financial and payment services, Rellevate will use funds to focus on market expansion and growth. “Rellevate has built a leading-edge digital banking, money movement and payments platform aimed at American workers that need it most. We are excited to work with the experienced Rellevate management team as they grow, said Mike

Rellevate Announces Justin Simmons as Vice President of Operations

Rellevate Announces Justin Simmons as Vice President of Operations Stamford, CT, April 14, 2022 – Rellevate, Inc., a fintech company dedicated to empowering consumers through leading-edge digital banking and payment services announces a new addition to their Senior Management Team. Rellevate is excited to announce the addition of Justin Simmons to our Management team. Justin will serve as Vice President of Operations for Rellevate. Justin comes to Rellevate from VMLY&R with extensive expertise in conceptualizing and developing in-house tools to streamline operational processes and build data, analytics, and reporting capabilities for Rellevate and its partner organizations. He genuinely enjoys investigating outlier data and exploring ways to increase visibility into data, allowing for more informed decision-making. “I am excited for the opportunity to join Rellevate during

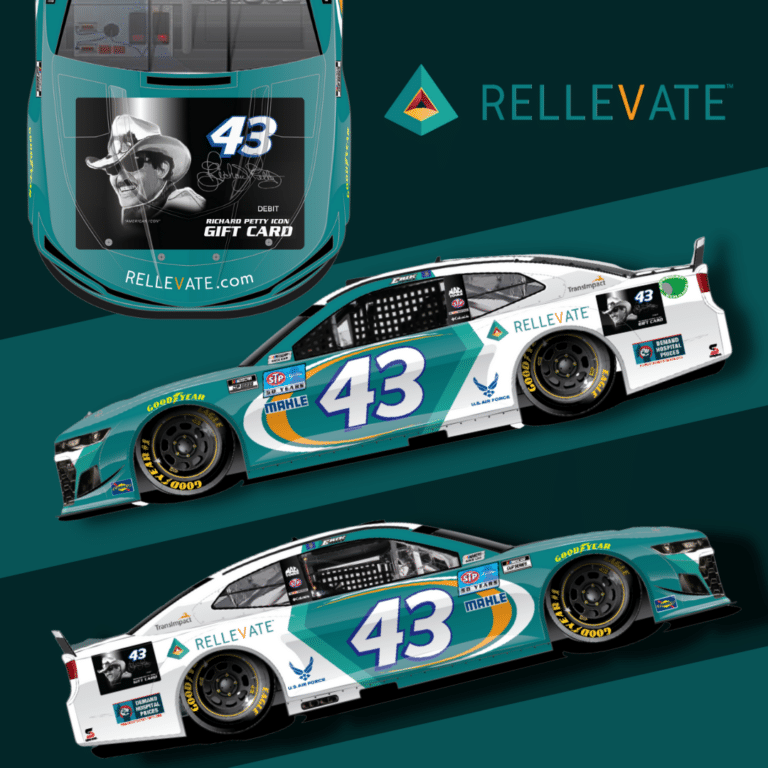

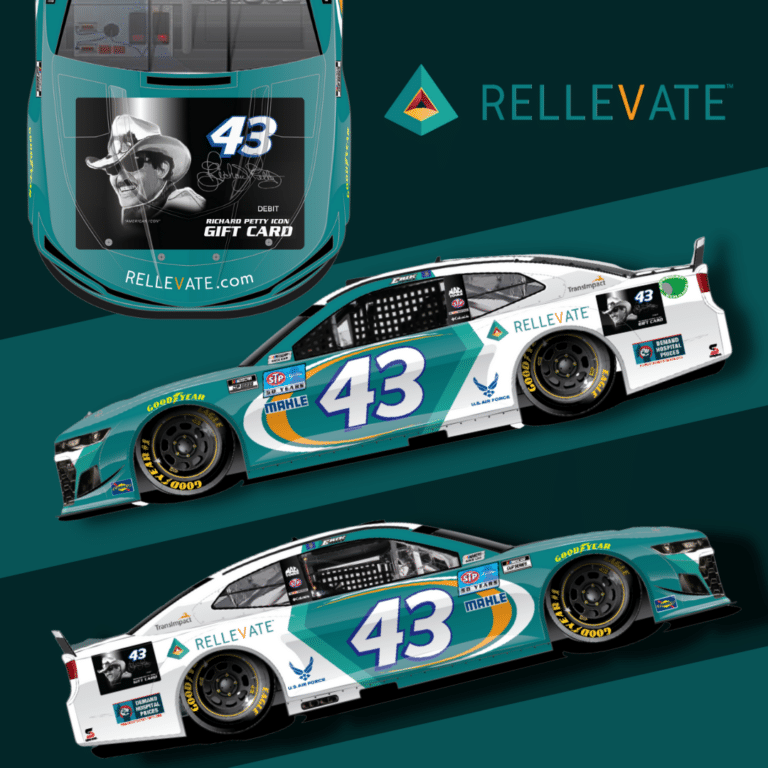

Rellevate and the Richard Petty Icon Gift Card at the Phoenix Raceway

Stamford, Conn. (Nov 2, 2021)—Rellevate, Inc., a fintech company dedicated to empowering consumers through leading-edge financial and payment services, partnered earlier this year with Richard Petty to introduce the Richard Petty Icon Gift Card. Rellevate and the Richard Petty Icon Gift Card will be showcased on the Richard Petty Motorsports No. 43 Chevrolet Camaro ZL1 1LE in the NASCAR Cup Series (NCS) at the Phoenix (Ariz.) Raceway, located in Phoenix, AZ on Sunday, November 7. “Rellevate is excited to be featured on the No. 43 Chevrolet Camaro ZL1 1LE for the NASCAR Cup Series season finale,” Stewart A. Stockdale, co-founder, chairman and CEO of Rellevate, said. “It is perfect timing as the holiday season quickly approaches, for Richard Petty fans to have the best gift

Rellevate Partners with Crocs to Bring Pay Any-Day Feature to Retail & Distribution Center Employees

Targeted Approach to Employee Financial Wellness Stamford, CT, October 25, 2021 – Rellevate, Inc., a fintech company dedicated to empowering consumers through leading-edge financial and payment services, announced it has partnered with Crocs, Inc. (NASDAQ: CROX), a global leader in innovative casual footwear, to introduce the Rellevate Digital Account with Pay Any-Day to their retail and distribution center employees working in the United States. Rellevate’s state-of-the-art digital platform strengthens organizations and their workforces, at no charge to employers. The Rellevate Digital Account features Pay Any-Day, which enables employers to offer employees secure and affordable access to earned wages, any time before their scheduled pay day. Rellevate’s Pay Any-Day (Earned Wage Access) can increase employee engagement, positively impact employee productivity and health, and ultimately reduce employer

Rellevate Commissions Study on the Impact of Earned Wage Access on Financial Wellness

RELLEVATE COMMISSIONS STUDY ON THE IMPACT OF EARNED WAGE ACCESS ON FINANCIAL WELLNESS – Study Uncovers the Painful Reality Facing 100 Million American Workers – Stamford, CT, June 2, 2021 – Rellevate, Inc., a fintech company dedicated to empowering consumers through leading-edge financial and payment services, has commissioned research conducted by Strategic Advisor and economist William M. Rodgers III, Ph.D. to assess the U.S. workforce’s current economic health and explore the impact that earned-wage-access (EWA) solutions could have on financial wellness. The report, available at Bridging the Gap, finds that even prior to the pandemic (1) low and moderate income families don’t have the income to make ends meet, nor the ability to absorb unanticipated expenses, (2) closing the gap between income and expenditures would

City of New Britain Partners with Rellevate

Contact: Sherry Goldman Goldman Communications Group 718-224-4133 sherry@goldmanpr.net FOR IMMEDIATE RELEASE City of New Britain Partners with Rellevate Administration Encourages Employee Financial Wellness Stamford, CT, May 19, 2021 – Rellevate, Inc., a fintech company dedicated to empowering consumers through leading-edge financial and payment services, announced it has partnered with the City of New Britain to introduce the Rellevate Digital Account with Pay Any-Day to their employees. Rellevate’s state-of-the-art digital platform strengthens organizations and their workforces, at no charge to employers. The Rellevate Digital Account features Pay Any-Day, which enables employers to offer employees secure and affordable access to earned wages, any time before their scheduled pay day. Other features of the Rellevate Digital Account include Bill Pay, Money Send and Visa® Debit Card. There are

Rellevate and Richard Petty Announce the Richard Petty Icon Gift and Reward Cards

For Immediate Release – January 22, 2021 Stamford, Conn. (January 22, 2021)—Rellevate, Inc., a fintech company dedicated to empowering consumers through leading-edge financial and payment services, announced today a multi-year licensing and distribution agreement with Richard Petty. The partnership will allow fans to buy gift and reward cards depicting Richard Petty, “The King,” an American icon. Petty is the winningest driver in the history of the National Association for Stock Car Auto Racing (NASCAR). “We look forward to bringing the Richard Petty Icon Gift and Reward Cards to fans by providing a mechanism for corporations to reward employee performance and build consumer promotions,” Jim Hannigan, vice president of licensing for Richard Petty Motorsports, said. “We will contribute a portion from each purchase to Victory Junction.”

Rellevate Joins UKG Technology Partner Network

Improving Employee’s Lives and Employer’s Bottom-lines through Financial Wellness Stamford, CT – December 7, 2020 – Rellevate, Inc., a fintech company dedicated to empowering consumers through leading-edge financial and payment services, announced it has joined the UKG Technology Partner Network, a collaborative ecosystem of organizations creating solution extensions for UKG Dimensions (formerly Workforce Dimensions from Kronos) and UKG Ready (formerly Kronos Workforce Ready) to amplify and elevate the employee experience. Rellevate’s state-of-the-art digital platform strengthens businesses and workforces, offering a powerful suite of financial services – featuring Pay Any-Day – that enables employers to offer their employees safe and secure access to their eligible earned wages based on actual hours worked in UKG Dimensions and UKG Ready at any time before their regularly scheduled pay day.

Insights

Complexities of NGO Finance

Non-profit organizations (NGOs) tackle critical global issues like poverty, climate change, and healthcare. However, managing finances is often daunting due to unpredictable income streams, strict compliance requirements, and increasing donor expectations. Addressing these challenges requires robust strategies and modern tools to ensure NGOs can maximize their impact and maintain donor trust. Key Takeaways Challenges in NGO Finance Effective financial management is a cornerstone of NGO success, but it comes with significant hurdles. Understanding these challenges is the first step toward overcoming them. Fundraising and Resource Allocation Financial Management and Reporting Managing multiple grants and projects with unique requirements can result in fragmented financial systems. These disjointed processes increase the risk of errors and make reporting more time-consuming. NGOs, especially those operating internationally, face intricate regulations.

The Future of NGO Finance: Trends, Innovations & Tech Solutions

The landscape of NGO finance is rapidly evolving, shaped by technology, changing donor priorities, and global challenges. For NGOs to maximize their impact, staying informed about emerging trends and adopting innovative solutions is essential. Key Takeaways: Key Trends Shaping the Future of NGO Finance 1. Digital Transformation Digital transformation is at the forefront of modern NGO finance. It enables organizations to enhance efficiency, improve security, and expand their reach. Cloud-Based Financial Systems Digital platforms offer flexibility and scalability, making them ideal for NGOs managing dynamic financial needs. These systems reduce the risk of data loss, enhance security protocols, and streamline financial reporting. They also support remote collaboration, ensuring teams worldwide can access real-time financial data. Mobile Payments Mobile payment systems revolutionize how NGOs distribute funds,

Maximizing Impact: The Power of Efficient Disbursement for NGOs

In the fast-paced world of non-profit organizations, time is of the essence. Every minute, every hour, and every day counts. With limited resources and a constant demand for accountability, efficiency becomes paramount. One area where efficiency can significantly impact an NGO’s ability to achieve its mission is disbursement processes. Key Takeaways: What is Disbursement? Disbursement refers to paying out funds to beneficiaries, vendors, or partners. This can involve various activities for NGOs, from paying salaries to funding critical projects. While it may seem routine, inefficient disbursement processes often lead to delays, errors, and operational bottlenecks. These challenges can undermine an NGO’s goals, emphasizing the importance of adopting efficient systems. The Impact of Inefficient Disbursement Inefficient disbursement can ripple through an organization, creating significant challenges: Delayed

Understanding Mass Payouts

Mass payouts are crucial to how money is distributed in various industries today. They allow businesses, governments, and other organizations to send money to many people quickly and efficiently. Understanding how mass payouts work, their benefits, and the challenges involved can help us understand why they are so important in our modern economy. Key Takeaways Introduction to Mass Payouts Mass payouts are a powerful tool that can help various industries manage their payments more effectively. This method allows organizations to send out large sums of money quickly and efficiently. In sectors like insurance, NGOs, and affiliate marketing, mass payouts play a crucial role. For instance, insurance companies can streamline claims payments, ensuring that clients receive their funds without unnecessary delays. NGOs often rely on mass

Types Of Insurance Disbursement Methods To Know About

Understanding the different ways money can be paid out is crucial in the world of insurance. This article explores various methods of insurance disbursement, making it easier for you to choose what works best for your situation. From lump-sum payments to modern digital solutions, each method has its own benefits and drawbacks that you should know about. Key Takeaways Direct Deposit How Direct Deposit Works Direct deposit is a method by which your insurance payouts are sent directly into your account. This means you don’t have to wait for a check to arrive in the mail. Instead, the money is transferred electronically, making it a quick and efficient way to receive your funds. This method is becoming increasingly popular due to its convenience. Pros and

Tips For Improving Claims Process

Improving the claims process is essential for ensuring that individuals and businesses receive the support they need during challenging times. By focusing on key areas such as documentation, communication, and technology, we can make the claims experience smoother and more efficient for everyone involved. This article provides valuable tips to enhance the claims process, making it easier for both claimants and claims professionals. Key Takeaways Understanding the Claims Process When you think about the claims process, it’s important to know what it really means. Understanding the key terms can help you navigate through it more easily. In today’s world, technology plays a huge role in making claims faster and more efficiently. For instance, innovative solutions like those from Rellevate offer instant digital transfers that make

Guide To Paying Volunteers With Stipends

When it comes to supporting volunteers, offering stipends can be a helpful way to show appreciation for their time and effort. This guide will explore what stipends are, their benefits, and how to set up a stipend program effectively. Understanding the ins and outs of paying volunteers with stipends can make a big difference in how organizations engage with their volunteers. Key Takeaways Understanding Stipends for Volunteers When you think about volunteer work, you might wonder, can volunteer work be paid? The answer is yes, but it’s usually in the form of a stipend. A stipend is a small payment meant to help cover basic living costs. This type of payment is often used for long-term volunteer positions, making it easier for people to commit

Over 80% Of Insurers Look To Fintech Partners For Instant Payment Solutions

What’s Happening and How Rellevate Can Help The Insurance sector is now placing an even higher importance on instant claim payouts and increased policyholder satisfaction resulting from a zero-cost out-of-pocket experience. 82% of large Insurance carriers and 77% of small carriers are now forging new or expanded partnerships with FinTech companies to accelerate and help navigate their real-time payment process The move to FinTech partnerships and real-time disbursements also accommodates the growing interest in ’embedded insurance’ and other non-traditional insurance arrangements. As these products become more ubiquitous, more executives recognize their substantial revenue potential with 81% of executives predicting that embedded insurance will quickly morph from a “nice-to-have” to a “must-have” The Importance of the Right FinTech Partnership: Going Instant may seem like a simple

Disbursement vs Reimbursement

In this article, we will explore the differences between disbursement and reimbursement. Understanding these two financial concepts is essential for managing money effectively in business operations. We’ll break down what each term means, how they are used, and why it matters to distinguish between them. Key Takeaways Understanding Disbursement and Reimbursement Definition of Disbursement Disbursement refers to money paid out by a business or organization. This can include payments for salaries, services, or even loans. For example, when a company pays its employees, that’s a disbursement. Disbursements can also happen in other contexts, like when a student receives a scholarship from a school. Definition of Reimbursement Reimbursement is when a business pays back someone for money they spent on behalf of the company. This often

What Is Disbursement & How Does It Work

A disbursement in business or government refers to the payment of money from a fund or account to a third party. Understanding how disbursement works is essential for businesses and individuals, as it affects budgeting, cash flow, and financial management. This article will explore the various aspects of disbursement, including its definition, types, processes, and real-world examples. Whether you are a student, a business owner, or just curious about financial transactions, this guide will help you grasp the concept of disbursement and its significance in everyday financial activities. Key Takeaways Compensation payments (wages, commissions, dividends) Supplier payments for goods and services Tax payments to the government Loan payouts to borrowers Grant distributions Insurance claim payouts Understanding Disbursement Definition of Disbursement A disbursement is simply the

Press Releases

Mayor Scott, Office of African American Male Engagement, and Rellevate Inc. Launch Same Day Work Pilot

View the original press release here. Partnership Advances Squeegee Collaborative Action Plan, Aims to Deliver Same-Day Payments to Former Squeegee Workers. BALTIMORE, MARYLAND, UNITED STATES, June 21, 2023 – Today, Mayor Scott announced a pilot program aimed to provide former squeegee workers with same-day work opportunities and a daily stipend beginning the week of June 19, 2023. In partnership with Rellevate Inc., a digital payment services provider, the Same Day Work Pilot Pay further expands the mission of the Mayor’s Office of African American Male Engagement (MOAAME) and the City’s Squeegee Collaborative Action Plan, by providing former squeegee workers with same-day work opportunities and swift payment of a daily stipend via a Rellevate Digital Account with Visa Debit Card. MOAAME coordinates the Same Day Work Pilot

Rellevate and Payroll4Free to Offer Financial Wellness Benefit to Business Clients

STAMFORD, CT, USA, August 18, 2022 /EINPresswire.com/ — Rellevate, Inc., a digital banking & payment services provider today announced a partnership with Payroll4Free, the only provider of free online payroll services, headquartered in Beachwood OH. Together they will offer Payroll4Free Clients and their employees’ access to Rellevate’s Digital Account with Earnings Credit, Visa Debit Card, Send Money, Bill Pay and Pay Any-Day, an Earned Wage Access product. “It is important to Rellevate to offer our comprehensive financial services tools to empower employees at both small and large companies, and the opportunity to work with Payroll4Free and their small business clients to provide this Financial Wellness benefit to their employees is rewarding, said Stewart Stockdale, Co-Founder, Chairman & CEO of Rellevate. “At virtually no cost to

Rellevate Secures Series Seed Preferred Investment to Scale Digital Banking and Payment Services Aimed for American Workers

Naples Technology Ventures led successful Capital Raise to Fuel Company’s Growth Stamford, CT, May 20, 2022 — Rellevate, Inc., a digital banking & payment services provider today announced that it closed a Series Seed Preferred $4 million round led by Naples Technology Ventures (NTV). Additional investors included Connecticut Innovations, IAG Capital Partners, Cherrystone Angel Group, Texas HALO Fund and Tamiami Angel Fund, among others. As a fintech company dedicated to empowering consumers through leading-edge financial and payment services, Rellevate will use funds to focus on market expansion and growth. “Rellevate has built a leading-edge digital banking, money movement and payments platform aimed at American workers that need it most. We are excited to work with the experienced Rellevate management team as they grow, said Mike

Rellevate Announces Justin Simmons as Vice President of Operations

Rellevate Announces Justin Simmons as Vice President of Operations Stamford, CT, April 14, 2022 – Rellevate, Inc., a fintech company dedicated to empowering consumers through leading-edge digital banking and payment services announces a new addition to their Senior Management Team. Rellevate is excited to announce the addition of Justin Simmons to our Management team. Justin will serve as Vice President of Operations for Rellevate. Justin comes to Rellevate from VMLY&R with extensive expertise in conceptualizing and developing in-house tools to streamline operational processes and build data, analytics, and reporting capabilities for Rellevate and its partner organizations. He genuinely enjoys investigating outlier data and exploring ways to increase visibility into data, allowing for more informed decision-making. “I am excited for the opportunity to join Rellevate during

Rellevate and the Richard Petty Icon Gift Card at the Phoenix Raceway

Stamford, Conn. (Nov 2, 2021)—Rellevate, Inc., a fintech company dedicated to empowering consumers through leading-edge financial and payment services, partnered earlier this year with Richard Petty to introduce the Richard Petty Icon Gift Card. Rellevate and the Richard Petty Icon Gift Card will be showcased on the Richard Petty Motorsports No. 43 Chevrolet Camaro ZL1 1LE in the NASCAR Cup Series (NCS) at the Phoenix (Ariz.) Raceway, located in Phoenix, AZ on Sunday, November 7. “Rellevate is excited to be featured on the No. 43 Chevrolet Camaro ZL1 1LE for the NASCAR Cup Series season finale,” Stewart A. Stockdale, co-founder, chairman and CEO of Rellevate, said. “It is perfect timing as the holiday season quickly approaches, for Richard Petty fans to have the best gift

Rellevate Partners with Crocs to Bring Pay Any-Day Feature to Retail & Distribution Center Employees

Targeted Approach to Employee Financial Wellness Stamford, CT, October 25, 2021 – Rellevate, Inc., a fintech company dedicated to empowering consumers through leading-edge financial and payment services, announced it has partnered with Crocs, Inc. (NASDAQ: CROX), a global leader in innovative casual footwear, to introduce the Rellevate Digital Account with Pay Any-Day to their retail and distribution center employees working in the United States. Rellevate’s state-of-the-art digital platform strengthens organizations and their workforces, at no charge to employers. The Rellevate Digital Account features Pay Any-Day, which enables employers to offer employees secure and affordable access to earned wages, any time before their scheduled pay day. Rellevate’s Pay Any-Day (Earned Wage Access) can increase employee engagement, positively impact employee productivity and health, and ultimately reduce employer

Rellevate Commissions Study on the Impact of Earned Wage Access on Financial Wellness

RELLEVATE COMMISSIONS STUDY ON THE IMPACT OF EARNED WAGE ACCESS ON FINANCIAL WELLNESS – Study Uncovers the Painful Reality Facing 100 Million American Workers – Stamford, CT, June 2, 2021 – Rellevate, Inc., a fintech company dedicated to empowering consumers through leading-edge financial and payment services, has commissioned research conducted by Strategic Advisor and economist William M. Rodgers III, Ph.D. to assess the U.S. workforce’s current economic health and explore the impact that earned-wage-access (EWA) solutions could have on financial wellness. The report, available at Bridging the Gap, finds that even prior to the pandemic (1) low and moderate income families don’t have the income to make ends meet, nor the ability to absorb unanticipated expenses, (2) closing the gap between income and expenditures would

City of New Britain Partners with Rellevate

Contact: Sherry Goldman Goldman Communications Group 718-224-4133 sherry@goldmanpr.net FOR IMMEDIATE RELEASE City of New Britain Partners with Rellevate Administration Encourages Employee Financial Wellness Stamford, CT, May 19, 2021 – Rellevate, Inc., a fintech company dedicated to empowering consumers through leading-edge financial and payment services, announced it has partnered with the City of New Britain to introduce the Rellevate Digital Account with Pay Any-Day to their employees. Rellevate’s state-of-the-art digital platform strengthens organizations and their workforces, at no charge to employers. The Rellevate Digital Account features Pay Any-Day, which enables employers to offer employees secure and affordable access to earned wages, any time before their scheduled pay day. Other features of the Rellevate Digital Account include Bill Pay, Money Send and Visa® Debit Card. There are

Rellevate and Richard Petty Announce the Richard Petty Icon Gift and Reward Cards

For Immediate Release – January 22, 2021 Stamford, Conn. (January 22, 2021)—Rellevate, Inc., a fintech company dedicated to empowering consumers through leading-edge financial and payment services, announced today a multi-year licensing and distribution agreement with Richard Petty. The partnership will allow fans to buy gift and reward cards depicting Richard Petty, “The King,” an American icon. Petty is the winningest driver in the history of the National Association for Stock Car Auto Racing (NASCAR). “We look forward to bringing the Richard Petty Icon Gift and Reward Cards to fans by providing a mechanism for corporations to reward employee performance and build consumer promotions,” Jim Hannigan, vice president of licensing for Richard Petty Motorsports, said. “We will contribute a portion from each purchase to Victory Junction.”

Rellevate Joins UKG Technology Partner Network

Improving Employee’s Lives and Employer’s Bottom-lines through Financial Wellness Stamford, CT – December 7, 2020 – Rellevate, Inc., a fintech company dedicated to empowering consumers through leading-edge financial and payment services, announced it has joined the UKG Technology Partner Network, a collaborative ecosystem of organizations creating solution extensions for UKG Dimensions (formerly Workforce Dimensions from Kronos) and UKG Ready (formerly Kronos Workforce Ready) to amplify and elevate the employee experience. Rellevate’s state-of-the-art digital platform strengthens businesses and workforces, offering a powerful suite of financial services – featuring Pay Any-Day – that enables employers to offer their employees safe and secure access to their eligible earned wages based on actual hours worked in UKG Dimensions and UKG Ready at any time before their regularly scheduled pay day.

News Desk

Complexities of NGO Finance

Non-profit organizations (NGOs) tackle critical global issues like poverty, climate change, and healthcare. However, managing finances is often daunting due to unpredictable income streams, strict compliance requirements, and increasing donor expectations. Addressing these challenges requires robust strategies and modern tools to ensure NGOs can maximize their impact and maintain donor trust. Key Takeaways Challenges in NGO Finance Effective financial management is a cornerstone of NGO success, but it comes with significant hurdles. Understanding these challenges is the first step toward overcoming them. Fundraising and Resource Allocation Financial Management and Reporting Managing multiple grants and projects with unique requirements can result in fragmented financial systems. These disjointed processes increase the risk of errors and make reporting more time-consuming. NGOs, especially those operating internationally, face intricate regulations.

The Future of NGO Finance: Trends, Innovations & Tech Solutions

The landscape of NGO finance is rapidly evolving, shaped by technology, changing donor priorities, and global challenges. For NGOs to maximize their impact, staying informed about emerging trends and adopting innovative solutions is essential. Key Takeaways: Key Trends Shaping the Future of NGO Finance 1. Digital Transformation Digital transformation is at the forefront of modern NGO finance. It enables organizations to enhance efficiency, improve security, and expand their reach. Cloud-Based Financial Systems Digital platforms offer flexibility and scalability, making them ideal for NGOs managing dynamic financial needs. These systems reduce the risk of data loss, enhance security protocols, and streamline financial reporting. They also support remote collaboration, ensuring teams worldwide can access real-time financial data. Mobile Payments Mobile payment systems revolutionize how NGOs distribute funds,

Maximizing Impact: The Power of Efficient Disbursement for NGOs

In the fast-paced world of non-profit organizations, time is of the essence. Every minute, every hour, and every day counts. With limited resources and a constant demand for accountability, efficiency becomes paramount. One area where efficiency can significantly impact an NGO’s ability to achieve its mission is disbursement processes. Key Takeaways: What is Disbursement? Disbursement refers to paying out funds to beneficiaries, vendors, or partners. This can involve various activities for NGOs, from paying salaries to funding critical projects. While it may seem routine, inefficient disbursement processes often lead to delays, errors, and operational bottlenecks. These challenges can undermine an NGO’s goals, emphasizing the importance of adopting efficient systems. The Impact of Inefficient Disbursement Inefficient disbursement can ripple through an organization, creating significant challenges: Delayed

Understanding Mass Payouts

Mass payouts are crucial to how money is distributed in various industries today. They allow businesses, governments, and other organizations to send money to many people quickly and efficiently. Understanding how mass payouts work, their benefits, and the challenges involved can help us understand why they are so important in our modern economy. Key Takeaways Introduction to Mass Payouts Mass payouts are a powerful tool that can help various industries manage their payments more effectively. This method allows organizations to send out large sums of money quickly and efficiently. In sectors like insurance, NGOs, and affiliate marketing, mass payouts play a crucial role. For instance, insurance companies can streamline claims payments, ensuring that clients receive their funds without unnecessary delays. NGOs often rely on mass

Types Of Insurance Disbursement Methods To Know About

Understanding the different ways money can be paid out is crucial in the world of insurance. This article explores various methods of insurance disbursement, making it easier for you to choose what works best for your situation. From lump-sum payments to modern digital solutions, each method has its own benefits and drawbacks that you should know about. Key Takeaways Direct Deposit How Direct Deposit Works Direct deposit is a method by which your insurance payouts are sent directly into your account. This means you don’t have to wait for a check to arrive in the mail. Instead, the money is transferred electronically, making it a quick and efficient way to receive your funds. This method is becoming increasingly popular due to its convenience. Pros and

Tips For Improving Claims Process

Improving the claims process is essential for ensuring that individuals and businesses receive the support they need during challenging times. By focusing on key areas such as documentation, communication, and technology, we can make the claims experience smoother and more efficient for everyone involved. This article provides valuable tips to enhance the claims process, making it easier for both claimants and claims professionals. Key Takeaways Understanding the Claims Process When you think about the claims process, it’s important to know what it really means. Understanding the key terms can help you navigate through it more easily. In today’s world, technology plays a huge role in making claims faster and more efficiently. For instance, innovative solutions like those from Rellevate offer instant digital transfers that make

Guide To Paying Volunteers With Stipends

When it comes to supporting volunteers, offering stipends can be a helpful way to show appreciation for their time and effort. This guide will explore what stipends are, their benefits, and how to set up a stipend program effectively. Understanding the ins and outs of paying volunteers with stipends can make a big difference in how organizations engage with their volunteers. Key Takeaways Understanding Stipends for Volunteers When you think about volunteer work, you might wonder, can volunteer work be paid? The answer is yes, but it’s usually in the form of a stipend. A stipend is a small payment meant to help cover basic living costs. This type of payment is often used for long-term volunteer positions, making it easier for people to commit

Over 80% Of Insurers Look To Fintech Partners For Instant Payment Solutions

What’s Happening and How Rellevate Can Help The Insurance sector is now placing an even higher importance on instant claim payouts and increased policyholder satisfaction resulting from a zero-cost out-of-pocket experience. 82% of large Insurance carriers and 77% of small carriers are now forging new or expanded partnerships with FinTech companies to accelerate and help navigate their real-time payment process The move to FinTech partnerships and real-time disbursements also accommodates the growing interest in ’embedded insurance’ and other non-traditional insurance arrangements. As these products become more ubiquitous, more executives recognize their substantial revenue potential with 81% of executives predicting that embedded insurance will quickly morph from a “nice-to-have” to a “must-have” The Importance of the Right FinTech Partnership: Going Instant may seem like a simple

Disbursement vs Reimbursement

In this article, we will explore the differences between disbursement and reimbursement. Understanding these two financial concepts is essential for managing money effectively in business operations. We’ll break down what each term means, how they are used, and why it matters to distinguish between them. Key Takeaways Understanding Disbursement and Reimbursement Definition of Disbursement Disbursement refers to money paid out by a business or organization. This can include payments for salaries, services, or even loans. For example, when a company pays its employees, that’s a disbursement. Disbursements can also happen in other contexts, like when a student receives a scholarship from a school. Definition of Reimbursement Reimbursement is when a business pays back someone for money they spent on behalf of the company. This often

What Is Disbursement & How Does It Work

A disbursement in business or government refers to the payment of money from a fund or account to a third party. Understanding how disbursement works is essential for businesses and individuals, as it affects budgeting, cash flow, and financial management. This article will explore the various aspects of disbursement, including its definition, types, processes, and real-world examples. Whether you are a student, a business owner, or just curious about financial transactions, this guide will help you grasp the concept of disbursement and its significance in everyday financial activities. Key Takeaways Compensation payments (wages, commissions, dividends) Supplier payments for goods and services Tax payments to the government Loan payouts to borrowers Grant distributions Insurance claim payouts Understanding Disbursement Definition of Disbursement A disbursement is simply the