Financial inclusion means making sure everyone has access to useful and affordable financial services. This includes things like savings accounts, loans, and insurance. When people can use these services, it helps them manage their money better and plan for the future. For employers, supporting financial inclusion can lead to a happier and more productive workforce.

Key Takeaways

- Financial inclusion helps reduce poverty and inequality by giving low-income individuals access to financial services.

- It promotes economic growth by enabling more people to save, invest, and start businesses.

- Small businesses benefit from financial inclusion through easier access to credit and innovative lending models.

- Financial inclusion empowers women by providing them with financial tools and resources, leading to better health and education outcomes.

- Employers play a crucial role in promoting financial inclusion by offering financial education and access to financial products.

The Role of Financial Inclusion in Reducing Poverty and Inequality

Access to Formal Financial Services

Financial inclusion ensures that everyone has access to formal financial services like savings, credit, and insurance. This access is crucial for managing finances and investing in income-generating activities. By providing these tools, financial inclusion can help lift people out of poverty and reduce economic disparities.

Empowering Marginalized Communities

Financial inclusion empowers marginalized communities by giving them the financial tools they need to succeed. This includes access to bank accounts, credit, and other financial products. With these resources, individuals can better manage their money and plan for the future, leading to improved financial stability.

Economic Disparities and Financial Tools

Economic disparities can be addressed through financial tools that promote inclusion. For example, earned wage access (EWA) programs can significantly enhance financial stability for employees, enabling timely bill payments and reducing reliance on payday loans. A study by the Aite Novarica Group reveals that over 95% of employees stopped using payday loans after adopting EWA, with 88% reporting improved financial management.

Related: Rellevate Commissions Study on the Impact of Earned Wage Access on Financial Wellness

Economic Growth Through Financial Inclusion

Participation in the Economy

When more people have access to financial services, they can actively participate in the economy. This means they can save money, invest in businesses, and buy goods and services. Financial inclusion helps everyone, from individuals to large companies, by ensuring that more people can participate in economic activities.

Savings and Investment

Having access to financial services allows people to save money and invest in their future. Savings accounts, for example, help people set aside money for emergencies or big purchases. Investment options can help people grow their wealth over time. This not only benefits individuals but also boosts the overall economy.

Entrepreneurship and Innovation

Financial inclusion supports new business ideas and innovations. When people can get loans or other financial help, they are more likely to start new businesses. This leads to more jobs and new products or services. Innovative financial solutions like earned wage access (EWA) can also help reduce turnover and hiring costs for businesses.

Supporting Small Businesses with Financial Inclusion

Challenges in Accessing Credit

Small businesses often face significant hurdles when trying to access credit. Traditional banks may view them as high-risk, making it difficult for these businesses to secure loans. This lack of access to credit can stifle growth and innovation. Many small businesses are not fully aware of the help available and how to access it, which means they don’t maximize the support that’s out there.

Innovative Lending Models

Innovative lending models have emerged to bridge this gap. Online platforms and fintech solutions offer alternative ways for small businesses to obtain funding. These models often use non-traditional data sources for credit scoring, making it easier for businesses with limited credit history to get loans. This is particularly beneficial for those who struggle with traditional banking sources.

Related: The Toolbox, The Toybox, And The Sandbox

Growth Opportunities for Entrepreneurs

Financial inclusion opens up numerous growth opportunities for entrepreneurs. With better access to credit and financial services, small businesses can invest in new projects, hire more employees, and expand their operations. This benefits the business owners and contributes to economic growth and job creation. Employers can play a crucial role by providing financial education and access to financial products, creating a supportive work environment for their employees.

Empowering Women Through Financial Inclusion

Gender-Specific Financial Initiatives

Financial inclusion initiatives tailored for women can significantly bridge the gender gap in financial services. These initiatives empower women economically by focusing on gender-specific financial products and literacy programs. For instance, providing access to microloans and savings accounts can help women start and grow their businesses, leading to greater financial independence.

Economic Empowerment of Women

Empowering women financially has a ripple effect on the broader economy. When women have control over their finances, they are more likely to invest in their families and communities. This can lead to improved educational opportunities for children and better health outcomes for families. Moreover, women with financial stability can contribute more effectively to the workforce, driving economic growth.

Improved Health and Education Outcomes

Financial inclusion for women also leads to better health and education outcomes. With access to financial services, women can afford healthcare and educational expenses, which improves their families’ overall well-being. This not only benefits individual households but also contributes to the social and economic development of communities.

The Intersection of Financial and Digital Inclusion

Role of Technology in Financial Services

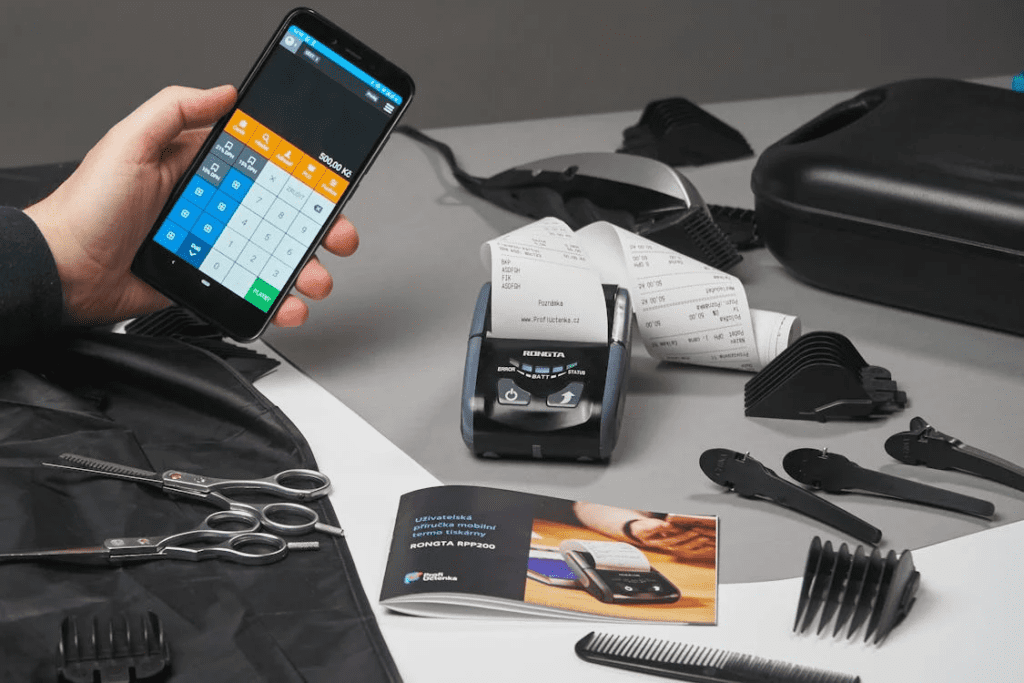

Technology plays a crucial role in expanding access to financial services. Digital platforms and mobile banking have made it easier for people to manage their finances, even in remote areas. Digital tools can help bridge the gap for those who are unbanked or underbanked, providing them with essential financial services.

Digital Financial Services

Digital financial services, such as mobile wallets, online banking, and digital payment systems, offer a range of benefits, including convenience, lower costs, and increased accessibility. By leveraging technology, financial institutions can reach a broader audience and offer more inclusive services.

Participation in the Digital Economy

Financial inclusion fosters digital inclusion, allowing more people to participate in the digital economy. Access to digital financial services enables individuals to engage in e-commerce, online education, and other digital activities. This participation can lead to economic growth and improved quality of life for many individuals.

Employer’s Role in Promoting Financial Inclusion

Providing Financial Education

Employers can play a crucial role in promoting financial inclusion by offering financial education to their employees. Financial illiteracy causes stress and anxiety in the workplace, which can affect productivity and overall well-being. By providing access to financial advice, counseling, and education on topics such as saving for retirement, budgeting, and reducing debt, employers can help their employees manage their finances better. This not only benefits the employees but also creates a more satisfied and productive workforce.

Access to Financial Products

Another way employers can promote financial inclusion is by providing access to financial products. Many employees, especially those from marginalized communities, may need access to basic financial services like bank accounts or loans. Employers can bridge this gap by offering products such as digital accounts, early access to pay, and other financial tools. This can help employees manage their finances more effectively and reduce financial stress.

Creating a Supportive Work Environment

Creating a supportive work environment is also essential for promoting financial inclusion at work. This includes fostering a culture of financial wellness and ensuring that all employees are aware of the financial benefits available to them. Regular communication and open discussions about financial well-being can help employees feel more secure and valued. Additionally, providing tools to measure participation and engagement in financial programs can help employers understand the needs of their workforce and make necessary adjustments.

Innovative Financial Solutions for Inclusive Growth

Fintech and Financial Accessibility

Fintech companies are revolutionizing the way people access financial services. By leveraging technology, these companies can offer innovative solutions that are more accessible and affordable. For instance, digital banking platforms allow users to manage their finances from their smartphones, making banking services available to those who might not have access to traditional banks. This shift is particularly beneficial for middle and lower-income Americans.

Alternative Credit Scoring

Traditional credit scoring methods often exclude individuals with limited credit history. However, alternative credit scoring models are changing this by considering non-traditional data sources, such as utility bill payments and rental history. This approach enables more people to access credit and other financial services, promoting greater financial inclusion.

Consumer Protection Frameworks

Protecting consumers is vital for building trust in financial services. Robust consumer protection measures are key to defending the rights of those who are financially vulnerable. These measures promote fair practices, transparent pricing, and ethical behavior from financial institutions, which, in turn, strengthens confidence in the financial system.

Rellevate, a digital fintech company, is dedicated to empowering middle and lower-income Americans through innovative digital banking and payment services. Their suite of financial services includes PayCard, Pay Any-Day (EWA), a Digital Account with a Visa Debit Card, Bill Pay, and Money Send, among others. This comprehensive approach helps users access, move, and use their money anytime, providing a significant boost to financial inclusion.

Discover how our innovative financial solutions can help you achieve inclusive growth. At Rellevate, we offer tools that make managing your money easier and more efficient. Don’t wait—take control of your financial future today!

Conclusion

Financial inclusion is more than just a buzzword; it’s a powerful tool that can transform lives and communities. For employers, embracing financial inclusion means providing their employees with access to essential financial services and education. This not only helps employees manage their finances better but also boosts their overall well-being and productivity. By supporting financial inclusion, employers can foster a more loyal and motivated workforce, which in turn can drive business success. In a world where financial stability is increasingly important, employers have a unique opportunity to significantly impact their employees’ lives and contribute to broader economic growth. Let’s work together to create a more inclusive financial future for everyone.